Rallying markets and flashing candlesticks can feel electrifying—especially when one quick trade doubles your money. Yet for many, that thrill morphs into an all-day obsession: charts on every screen, phantom pings in the night, and gut-wrenching swings that hijack mood and savings alike. Stock trading addiction turns investing from a measured wealth-building tool into a dopamine-chasing gamble. Below, you’ll learn just how widespread the issue is, why some traders spiral while others keep perspective, the tell-tale danger signs, and—most importantly—proven ways to step back, regain control, and build a healthier relationship with the markets.

Table of Contents

- Trading Frenzy: Scope, Statistics, and Global Trends

- Under the Ticker Tape: Biological, Psychological, and Market Forces

- Red Flags on the Dashboard: How to Recognize Problem Trading

- Downstream Damage: Financial, Emotional, and Social Repercussions

- Resetting the Portfolio: Clinical Help, Self-Help, and Staying Balanced

- FAQ

Trading Frenzy: Scope, Statistics, and Global Trends

Retail trading has exploded. Zero-commission apps, viral “meme stocks,” and pandemic lockdowns lured an estimated 25–40 million new individuals worldwide into day-trading between 2020 and 2024. One U.S. broker reported that 70 percent of its current account holders opened during that window.

Volume tells the story. Retail investors now generate up to 23 percent of daily U.S. equity trading and as much as one-third of options volume—products notorious for leverage and rapid swings. Internationally, South Korea, India, and Germany show similar surges in smartphone-based trading.

Problem-trading prevalence. Behavioral-addiction researchers estimate 2–5 percent of active retail traders meet criteria for trading disorder: compulsive market engagement, escalating risks, and significant life disruption. Among options and leveraged crypto traders, rates may be even higher.

Why now? Algorithmic newsfeeds, influencer “gurus,” and gamified brokerage interfaces (confetti, leaderboards) blend entertainment and investing. Push notifications about after-hours earnings or pre-market gaps keep brains on high alert nearly 24/7.

Takeaway: The democratization of markets provides opportunity—but also unprecedented access to high-risk, high-dopamine environments, making vigilance essential.

Under the Ticker Tape: Biological, Psychological, and Market Forces

Stock trading addiction doesn’t stem from greed alone. It lives at the intersection of brain chemistry, personality traits, and an ecosystem designed to captivate.

Neural circuitry in overdrive

- Dopamine jackpot. Each profitable trade triggers a reward surge; even momentary unrealized gains light up the nucleus accumbens.

- Near-miss phenomenon. Watching a stock spike seconds after a sale feels almost like winning, nudging traders to re-enter hastily.

- Variable reinforcement. Markets deliver wins on an unpredictable schedule—mirroring slot-machine odds that foster addiction.

Personality catalysts

- Sensation seekers crave fast-moving instruments (options, small-caps).

- Perfectionists double down to “fix” a losing decision.

- Individuals with ADHD gravitate toward rapid-fire scalping for constant stimulation.

Market-driven accelerants

- Leverage. Margin accounts and options multiply gains—and losses—intensifying emotional stakes.

- 24-hour news. Global time zones mean some market is always open, eroding natural stopping points.

- Social echo chambers. Reddit threads, Discord servers, and Twitter (X) spaces amplify FOMO and rumor-driven trades.

Insight: Effective recovery plans must address neurochemical hooks, mindset traps, and the attention-hijacking design of modern trading platforms.

Red Flags on the Dashboard: How to Recognize Problem Trading

Because trading can still be intellectually engaging and financially rewarding in moderation, problem behavior often hides behind phrases like “I’m just managing my portfolio.” Watch for these indicators.

Behavioral warning signs

- Glancing at tickers every few minutes—even during social events.

- Repeatedly canceling plans to “watch the open” or “ride the close.”

- Using multiple devices to track quotes, news, and option chains simultaneously.

- Chasing losses: increasing position size after drawdowns to break even.

- Lying about trades or secretly opening new brokerage accounts.

Self-audit questions

- Do market movements dictate your mood more than personal events?

- Do you trade larger sums or riskier derivatives to feel the same rush?

- Have you borrowed funds or used margin to cover escalating trades?

- Do you neglect work, sleep, or relationships for after-hours research?

If you answered “yes” to two or more, consider a professional screening.

Clinical assessment roadmap

- Standard tools. Adapted Gambling Disorder criteria, the Stock Trading Addiction Scale (emerging), or the South Oaks Gambling Screen with trading-specific prompts.

- Financial review. Compare risk exposure and drawdowns to net worth and income.

- Mental-health screening. Check for co-occurring anxiety, depression, or stimulant misuse.

- Suicidality check. Sudden market crashes can precipitate self-harm thoughts—assess regularly.

Downstream Damage: Financial, Emotional, and Social Repercussions

The ticker tape may look harmless, but compulsive trading can ripple through every life domain.

Monetary fallout

- Runaway leverage. Margin calls force asset liquidation, devastating retirement plans.

- Tax pitfalls. Unplanned short-term gains produce large bills; wash-sale violations disallow losses.

- Opportunity cost. Cash tied in day-trading could have earned compound growth in diversified funds.

Psychological strain

- Chronic stress. Heart-rate spikes mirror high-stakes poker, raising cortisol levels.

- Sleep disruption. Futures market openings at 6 p.m. ET keep minds racing.

- Identity fusion. Self-worth tethered to daily P&L charts invites depression after losing streaks.

Relationship turmoil

- Hiding losses breeds mistrust.

- Ignoring family while monitoring aftermarket earnings erodes intimacy.

- Borrowing from friends to “cover margin” strains support networks.

Physical health impacts

- Sedentary screen time contributes to weight gain and eye strain.

- Caffeine or stimulant overuse to stay alert for pre-market moves impairs cardiovascular health.

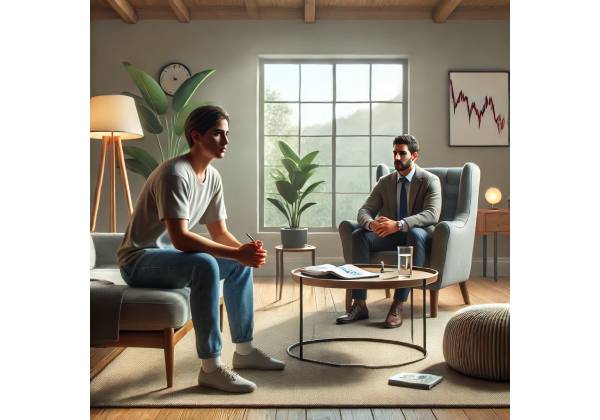

Resetting the Portfolio: Clinical Help, Self-Help, and Staying Balanced

Recovery swaps compulsive speculation for structured investing—or complete abstinence—while restoring mental and financial health.

Evidence-based therapies

- Cognitive-Behavioral Therapy (CBT-TD). Targets illusions of control, loss-chasing, and “hot-hand” fallacies.

- Dialectical Behavior Therapy (DBT) skills. Teaches distress tolerance during volatile markets and emotion regulation after losses.

- Motivational Enhancement. Strengthens commitment by contrasting life values with destructive trading.

Medication options

- Naltrexone. Reduces urge intensity by modulating reward pathways.

- SSRIs/SNRIs. Address underlying anxiety or depression fueling excessive trades.

- Mood stabilizers. Helpful for traders with bipolar tendencies triggered by market swings.

Financial safeguards

- Convert speculative accounts to read-only mode for 30–90 days.

- Route paychecks to a separate bank lacking instant brokerage transfers.

- Work with a fiduciary advisor to craft a rules-based, automated investment plan.

Tech and environmental hacks

- Remove trading apps from the phone; use desktop only during scheduled windows.

- Disable market alerts outside preset hours.

- Unfollow “trade call” influencers; follow long-term investing educators instead.

Peer and family reinforcement

- Day-Trading Anonymous or Gamblers Anonymous meetings provide shared language and accountability.

- Couples counseling repairs trust, sets transparency budget dashboards.

- Mentorship programs pair recovering traders with financial planners or seasoned investors who model patience.

Relapse-proof routine

- Morning ritual. Mindful breathing before any screen exposure.

- Set trading curfew. No platforms after 3 p.m. local time.

- Urge log. Track cravings, triggers, and alternative actions (exercise, journaling).

- Monthly review. Compare actual life goals (health, relationships) with trading behavior; adjust safeguards.

- Reward milestones. Use saved commission costs for experiences—trips, classes, or charitable donations.

Case spotlight: Jenna, 33, lost $50 000 day-trading low-float stocks. After entering CBT-TD, she transferred her account to a robo-advisor, joined a hiking club for weekday mornings, and set her phone to grayscale during market hours. Two years later she maintains a diversified portfolio, sleeps soundly through earnings season, and mentors others on balanced finance.

Bottom line: Blending therapy, financial restructuring, tech barriers, and fulfilling offline pursuits can turn market mania into mindful money stewardship.

FAQ

How is stock trading addiction different from gambling?

Both involve uncertain rewards and dopamine spikes. The main difference is perceived legitimacy—stocks represent real companies—but the behavioral mechanics of compulsive trading closely mirror gambling disorder.

Do I have to quit trading forever?

Not necessarily. Some people shift to passive index investing with strict rules; others choose abstinence. Safety hinges on honest self-assessment and guardrails.

Is options trading always dangerous?

Options are tools; risk depends on leverage and strategy. For those prone to addiction, the speed and volatility make them higher-risk than long-term stock holding.

Can automated “copy trading” help?

It reduces manual impulse clicks but can still trigger dopamine via live P&L swings. Combine with caps on capital and regular review.

What withdrawal symptoms should I expect?

Anxiety, boredom, irritability, and urge spikes during market hours typically peak within two weeks, then taper with new routines.

Does having multiple brokerage accounts matter?

Yes. More accounts mean easier hiding of losses and harder self-tracking. Consolidate or freeze extra accounts during recovery.

Will meditation really curb cravings?

Mindfulness lowers stress hormones and increases urge awareness, giving you a pause to choose healthier actions.

Are tax losses deductible if I stop trading?

Capital losses up to \$3 000 annually offset ordinary income; remaining losses carry forward—consult a tax professional.

Can I use trading simulators while recovering?

Paper trading can either scratch the itch safely or trigger relapse. Discuss with a therapist before experimenting.

Where can I find specialized help?

Search for certified gambling counselors, financial therapists, or addiction psychiatrists; many now offer telehealth.

Disclaimer: The content above is for educational purposes only and is not a substitute for individualized medical, psychological, or financial advice. Always consult qualified professionals before making significant changes to trading habits or treatment plans.

If this article brought clarity or comfort, please share it on Facebook, X (formerly Twitter), or any platform you prefer. Your support helps others discover crucial resources and motivates us to keep delivering trustworthy, reader-friendly guidance. Follow us for more insights—together we can cultivate healthier approaches to money and mental well-being!